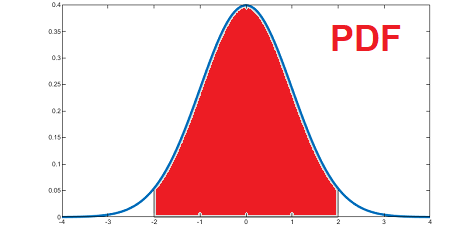

A statistical expression or function that determines the probabilities of occurrence of different possible outcomes for a continuous random variable, such as actively traded instruments/ securities, exchange-traded products (e.g., ETF) and derivative products.

A probability density function (PDF) completely characterizes the distribution of a continuous random variable. It is one of two key methods used to define the probability distribution of a random variable. The former involves assigning a probability to each value that the variable (by necessity a discrete variable) can take, while the latter (PDF) is based on assigning probabilities to intervals of values that the variable (a continuous variable) can take.

In the diagram above, the blue line (continuous) is the PDF of a normal random variable, and the read area constitutes the probability that the random variable takes a value in the interval between -2 and 2.

It shall be noted that the probability density function characterizes the distribution of a continuous random variable, and hence it is not a probability of occurrence. In contrast, the probability mass function characterizes the distribution of a discrete random variable.

Comments